What exactly is a banking network? Well, it’s not just a maze of ATMs and bank branches; it’s the backbone of how our finances move in this digital age. Banking networks have evolved from brick-and-mortar behemoths to sleek, digital ecosystems. Let’s embark on a journey through time, exploring how these networks have transformed, revolutionizing the way we manage our money.

A Brief History: Before the Digital Wave

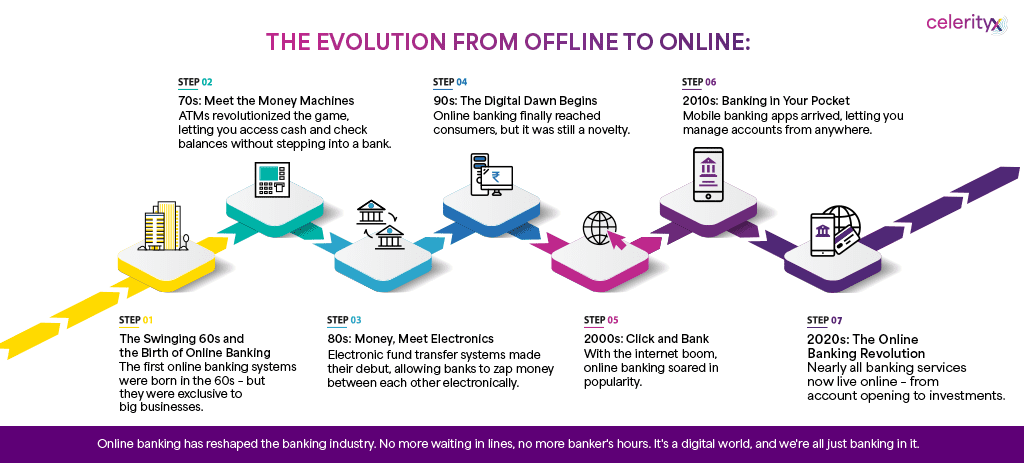

Before we delve into the digital realm, let’s rewind a bit. In the ’60s, the concept of online banking was like science fiction – it existed, but only for large businesses. The rest of us? We were stuck in lines at the bank, jotting down every transaction in our cheque books. That’s an ancient relic today!

The Backbone of Banking: Safe and Secure Enterprise-Grade Networks

While we’ve marveled at the journey of banking networks, it’s essential to recognize the critical role of robust, enterprise-grade networks in modern banking.

Why Security Matters:

In today’s world, where cyber threats loom large, ensuring the security of financial transactions is paramount. Enterprise-grade networks provide the fortification needed to protect sensitive financial data. They’re equipped with layers of security protocols, firewalls, and encryption, creating digital fortresses against potential breaches.

Reliability is Key:

Imagine the chaos if your bank’s network was to go down unexpectedly. Enterprise-grade networks are designed for reliability. They boost redundancy, failover mechanisms, and 24/7 monitoring to ensure uninterrupted service. Your financial transactions, whether online or at an ATM, rely on the stability of these networks.

Faster, Smoother Transactions:

In the digital age, speed matters. Enterprise networks are optimized for swift data transfer, enabling real-time processing of transactions. Whether you’re transferring funds, checking your balance, or making an online payment, the efficiency of these networks ensures seamless experiences.

Scaling for the Future:

As banking continues to evolve, so do the demands on networks. Enterprise-grade networks are scalable, and capable of accommodating growing volumes of digital transactions and the integration of emerging technologies like blockchain and open banking.

Protecting Customer Trust:

Most importantly, these networks safeguard the trust of customers. In an era where data breaches make headlines, banks must prove that they can be trusted custodians of personal financial information. Enterprise-grade networks play a pivotal role in maintaining this trust.

Conclusion

In summary, banking networks have come a long way, and they’re not stopping anytime soon. Predicting the future is tricky, but one thing’s for sure: banking will continue to evolve, embracing digital innovation and making our financial lives more accessible and convenient.

At the forefront of this evolution stands CelerityX, a revolutionary force in bolstering banking networks. With a suite of cutting-edge solutions designed for enterprise-grade networks, CelerityX ensures that the backbone of modern banking remains robust, secure, and ready to embrace the challenges and opportunities of the digital age.

From enhancing security protocols to optimizing data transfer speeds, CelerityX’s offerings are tailored to the specific needs of the banking industry. The result? A banking network that not only meets today’s demands but is also prepared for the innovations and challenges of tomorrow.