A Progressive Cooperative Credit Society in the Digital Age

Samata Pathsanstha: A Model for Growth

- Established in 1986: Samata Pathsanstha began with a focus on serving small traders in Kopargaon.

- Strong Financial Performance: Over the years, it has grown significantly, exceeding a combined business of Rs. 1200 crore in 2022.

- Widespread Network: The society boasts 40 branches, 23 gold loan extension counters, and over 87,500 members.

Embracing Digitalization for Enhanced Services

Samata Pathsanstha has adopted a progressive approach to technology:

- Comprehensive Digital Banking: They offer a full suite of digital banking services, including mobile banking, paperless banking, net banking, core banking solutions, and online transactions.

- Seamless User Experience: Their innovative features like missed-call deposits and instant receipts simplify transactions for members.

- Market Leader in Digitalization: Samata Pathsanstha is recognized as a pioneer in digital adoption among credit societies in Maharashtra.

A Progressive Cooperative Credit Society in the Digital Age

Lack of awareness among members and staff about cybersecurity threats and best practices.

Weak security practices within credit societies.

Human error, such as clicking on malicious links or opening infected attachments.

By implementing strong cybersecurity measures, credit societies can mitigate these risks and protect their members’ financial information.

Samata Pathsanstha: A Security Leader

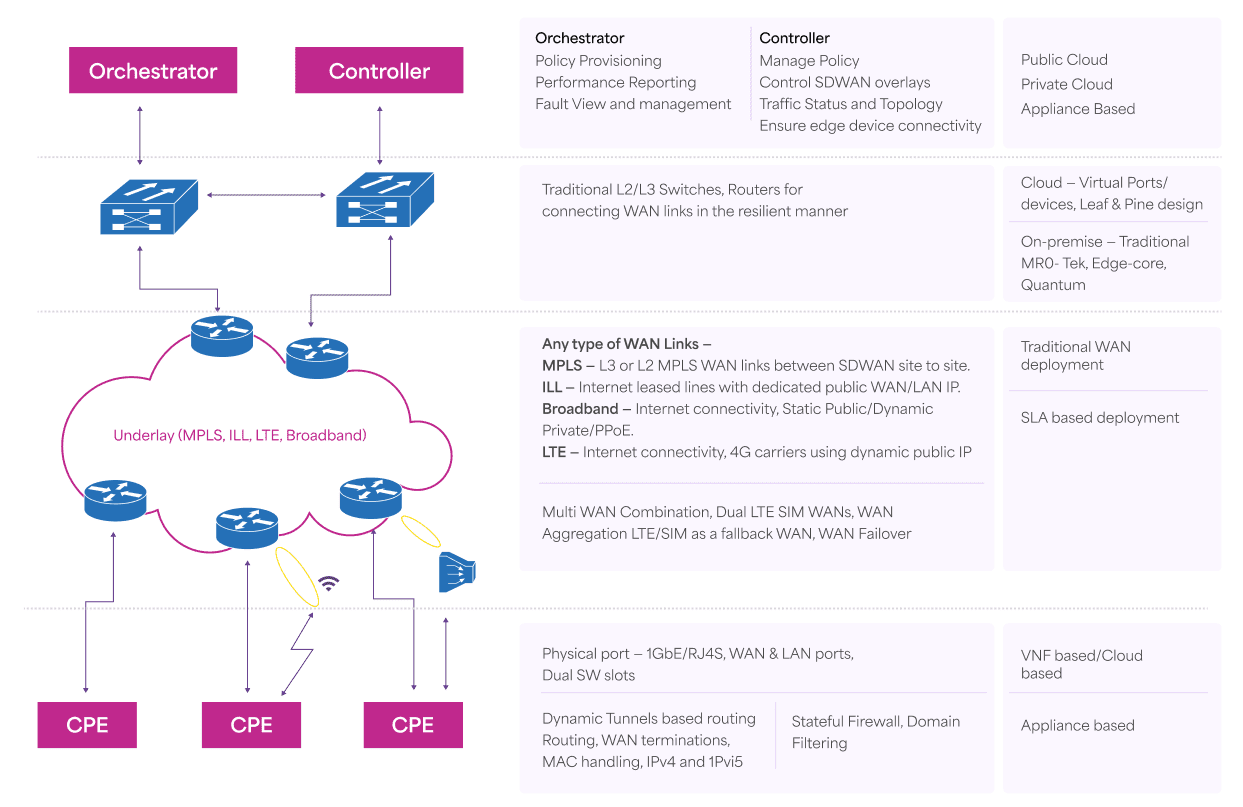

OneX Architecture

Samata Pathsanstha’s journey showcases how CCSs can leverage digitalization to enhance member services and financial inclusion. However, robust cybersecurity measures are indispensable in the digital age. By implementing OneX by CelerityX, Samata Pathsanstha has significantly strengthened its defenses against cyber threats. This case study highlights the importance of cybersecurity for all credit societies and how solutions like OneX can empower them to thrive in the digital landscape.